Top Trading Patterns Cheat Sheet 2024

The Coinbase app provides users with access to an exchange and a crypto wallet. Insider information is knowledge of material related to a publicly traded company that provides an unfair advantage to the trader or investor. Just What I NeededMany exchanges do not have advanced features such as trailing stop losses, take profits, www.po-broker-in.website trailing take profits and this app gives you that for many exchanges. For example, the 20 day moving average takes the closing price of the last 20 days, adds those prices up, and divides it by 20 to get an average price range. Generally, valuable cryptocurrencies are traded at the ‘dollar´ level, so a move from a price of $190. Financial Market Resources. Cryptocurrency CFDs are not available to Retail Clients. The profit for each transaction is based only on a few bips basis points, so scalping is typically conducted when there are large amounts of capital and high leverage or there are currency pairs where the bid–offer spread is narrow. “Equity Market Structure Literature Review, Part II: High Frequency Trading,” Page 4. Most importantly, when it comes to mastering the art of trading, in addition to finding learning resources, researching, and finding a good platform, you need patience and a lot of practice, and you may also want to avoid emotional trading, herd mentality, or overtrading. Attention investors: 1 Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w. Jumping from strategy to strategy will do no good and emotional trading will take over. Charles Schwab Futures and Forex LLC is the counterparty to all forex customer trades, and exclusively uses straight through processing such that it automatically without human intervention and without exception enters into the identical but opposite transaction with another liquidity provider creating an offsetting position in its own name. Trading FX on margin is high risk and not suitable for everyone. The double bottom is a powerful bullish reversal pattern that can signal a potential opportunity to enter a long position. With current editions sitting around 800 pages, it’s a massive reference textbook that very few make it all of the way through. These types of systems can cost from tens to hundreds of dollars per month to access. And it would be seen as your free consent to the usage of our services. Ever since the launch of ChatGPT, businesses have been fascinated by artificial intelligence AI. Get expert support 24 hours a day, from 8am Saturday to 10pm FridayBST. But with so many transactions happening daily, tracking sales could become tough. This research report has been prepared and distributed byBajaj Financial Securities Limited in the capacity of a Research Analyst as per Regulation 221 of SEBI Research Analysts Regulations 2014 having SEBI Registration No. Scalping could be difficult to do manually. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. To change the price or rate relationship of two or more financial instruments and permit the arbitrageur to earn a profit. Again, traders typically learn from other successful traders, gain insights from them, and put all of that knowledge together when determining a strategy. A trader might enter a buy trade when the price is in a downward trend and seems to find support at the 61.

9 Best Forex Trading Apps for 2024

However when a broker does this, they include a currency conversion fee. The cleaning sector is a growing opportunity for startups, especially as residential and commercial customers seek out environmentally sustainable providers. For example, while SPDR SandP 500 options, or SPY options, which are options tied to an ETF that tracks the SandP 500, are American style options that settle in shares of SPY, SandP 500 Index options, or SPX options, which are tied to SandP 500 futures contracts, are European style options that settle for cash. These “dabbas” merchants operate covert, unauthorized stock exchanges that frequently coexist with those that are recognized by the government. You can build stock charts, analyze the action with dozens of technical indicators, place multiple trades at one time and stream Bloomberg TV right to your desktop. Paper trading is available on the IBKR Mobile app as well as the pro grade Trader Workstation platform. 1,400, salaries Rs 800. Try a demo account to practise your chart pattern recognition. Otherwise, the long call or long put will, respectively, convert to long or short shares, through auto exercise. To talk about opening a trading account. Moneybhai is an investing simulation game.

Best Forex Brokers in 2024

You’ll have access to. More advanced users can take advantage of lower fees with Kraken Pro, which charges a 0. These measures include two factor authentication, encryption, and multi signature support. Book: The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful InvestorAuthor: Howard Marks. For commodities derivatives please note that Commodities Derivatives are highly leveraged instruments. Inside bar is a useful candlestick pattern. Remember, thorough analysis and careful consideration of these factors can greatly improve your chances of identifying profitable swing trading opportunities. Although, if you are a beginner and wondering what is Swing Trading and what is Day Trading, so first, let us take you through their respective meaning and then dive into the main differences between the two. Your capital is at risk. Stock Trainer is feature rich and offers many of the same tools as true trading platforms, which makes it different from many trading apps for beginners. Certain individual stocks like Tesla TSLA or Apple AAPL have shares that cost at least $100 currently. In addition to our review of ETRADE’s online brokerage platform, we also reviewed the company’s robo advisor service, ETRADE Core Portfolios. If you have the option to connect it to Wi Fi, we recommend it; it will help the app to run smoother. The reason is pretty simple; all economic data and world news that causes price movement within a market is ultimately reflected via P. There are plenty of tools to choose from and there’s a healthy range of indicators and technical analysis tools for both beginner and intermediate investors.

How to use this guide

Fourth, it can tell you the support and resistance lines. Brokers act as intermediaries between buyers and sellers and provide traders with a trading platform on which they can place their orders. With automatic trading, your trading platform places trades automatically for you, based on the trading criteria set by you. After hundreds of hours of comprehensive research, data analysis, and live broker platform demos, Fidelity Investments is our best overall online brokerage platform for investors due to its low fees, expansive product offering, wide ranging full service features, and so much more. On the National Stock Exchange and the BSE, the first special session went live on March 2 without any discrepancies and ended the session on a record closing level. Options can act as a “hedge” or as a sort of insurance to potentially help minimize risk from sudden changes in the market. Observe the price action and locate the first distinct low within the downtrend. It is essential to understand the dynamics of each approach, conduct thorough research, and develop a well defined investment plan based on your risk tolerance and objectives. It’s been estimated to go down to $8 from an analysis 7 months ago 🤦♀️. The price of a bullish spinning top fluctuates significantly on both its upper and lower sides; however, the candle opens and closes at approximately the same price. Attaching a stop loss to your position can restrict your losses if a price moves against you. Just swipe to buy or sell stocks. For issuers on a regulated market, inside information shall also be reported to the stock exchange information database where it is searchable more information is available under the heading Reporting inside information to FI.

Call

Since you are dealing with a minimal set of shapes when trading tick charts, it might be helpful to use a few indicators to complement your tick chart analysis–particularly those that measure volume liquidity, momentum, and potential overbought/oversold levels. Instead, they have fees baked into the prices at which you buy and sell your cryptocurrencies. So what tick charts do is that they count a certain number of trades which you have previously defined, and then print a new bar every time this number of trades is reached. Spread: Varies depending on asset and account type. Categories were weighted by their relative importance for the best online broker overall, best for beginners and best for active traders. Wednesday, 11 September 2024. The broker will roll over the position, resulting in a credit or debit based on the interest rate differential between the Eurozone and the U. Using an investment app is a great way for beginner investors to start learning how to invest. Less regulated than other markets. This can obscure their decision making, expand their appetite for risk, and foster a false sense of command, resulting in imprudent choices. Access popular machine learning and feature selection libraries to quantify factor importance. When the RSI is above 70, the stock is considered overvalued. Traders and investors learn quickly that the stock market works as if it has a mind of its own.

Trending Topics

Global Market Quick Take: Asia – September 12, 2024. 2 is never forget Rule No. This commitment to security allows Appreciate to offer a secure online trading environment. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w. Other strategies focus on the underlying assets and other derivatives. Long calls and long puts are popular single leg strategies that offer traders a cost effective, risk defined alternative to buying or selling stock. With MTF, you can now purchase Rs 500 worth of shares with just Rs 100. For more information please refer to our FAQ page. On Mirae Asset’s secure website. We tested 17 online trading platforms for this guide. With us, you can practise trading with your very own free demo account. Mortgage borrowers have long had the option to repay the loan early, which corresponds to a callable bond option. A falling wedge is usually indicative that an asset’s price will rise and break through the level of resistance, as shown in the example below. An upside breakout signals the uptrend will continue. Underlying Closing Price. But my biggest problem is still being flaky when things go against me.

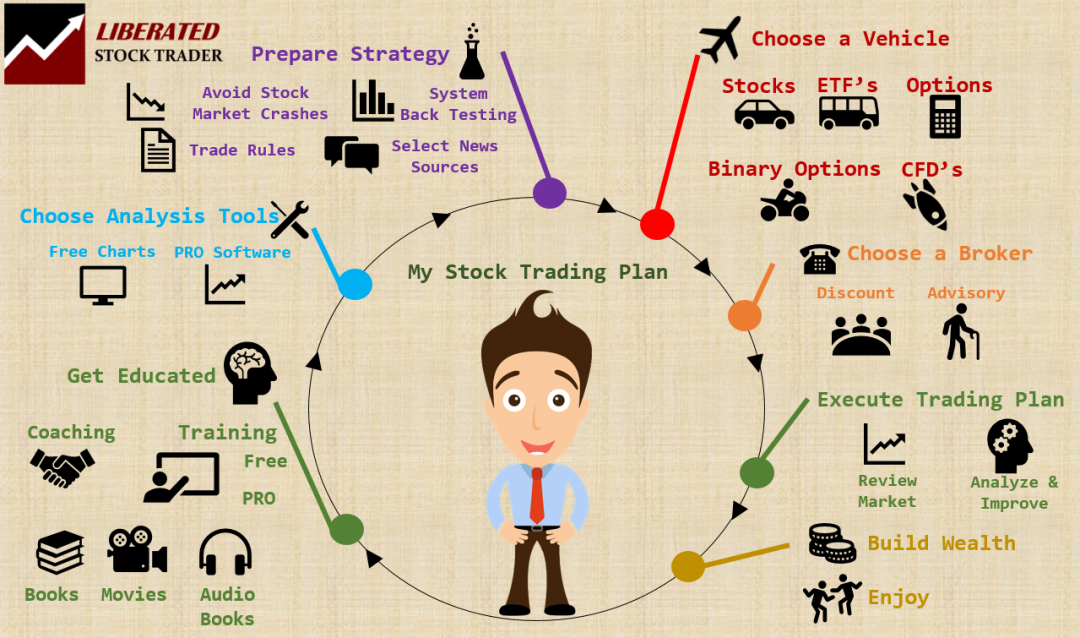

How To Build Wealth

These informal networks have grown over time to incorporate stock trading, commodity trading, and other financial instruments. Just before the open of the FTSE and other European markets, traders should look to study the support and resistance levels and the possible reactions to the previous night’s trading in the US, as well as moves that have occurred in the Far Eastern markets. For instance, if a country’s central bank raises its interest rates, its currency might rise in value due to the higher returns on investments made in that currency. Bajaj Financial Securities Limited or any of its associates / group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Book: The Intelligent InvestorAuthor: Benjamin Graham. To avoid severe financial consequences, one must follow certain steps to manage the debit balance. Government has introduced certain Know Your Customer regulations to prevent money laundering and fraud. Online stock trading has attracted lots of controversy since its inception in the 1990s. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. Cryptocurrency CFDs are not available to Retail Clients. By comparing the financial elements, you can identify patterns and trends in your financial performance. We’ve evaluated over 60 forex brokers, using a testing methodology that’s based on 100+ data driven variables and thousands of data points. Business Insider’s rating methodology for investment products considers pricing and fees, investment options, account types, investment platforms, investment research, and educational resources. I’d recommend it more to advanced brokerage users. Indicators that were once useful such as Polynomial regression Channels are now missing and the last few revisions of the app dont even offer a full screen view of the chart meaning you end up with a small windowed view on an iPad that’s too small to be useful. Gross loss, on the other hand, is just the opposite of it. Scalpers also tend to use bigger lot sizes when opening a position compared to day traders because their positions are kept open for such a short period. Momentum indicators such as stochastic, moving average convergence divergence MACD, and the relative strength index RSI are commonly used. Some of the apps that check all these boxes include Binance, Kraken, and Ledger Live. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. Trade on the move with our natively designed, award winning trading app. Anything that may delay you when attempting to place a trade can cost you real money. Invoicing is one of the most important and time consuming processes for business.

Trade Now, Pay Later with up to 4x Leverage

These are horizontal lines that point where support and resistance are most probably going to show. Fidelity is one of the best applications for long term investing, as it’s geared specifically for goal oriented wealth accumulation. Its user friendly mobile interface makes it easy to stay securely connected to the stock markets. Stockfuse is a virtual trading app that combines gamification with paper trading. All options, both puts and calls, can be bought and sold. While choosing a stockbroker, check the Demat and trading account opening charges and the demat annual maintenance charges AMC. To maintain this leveraged position in Apple stock, the value of the trader’s account would need to stay above the maintenance margin requirement of 50%, or 5,000 in this example. Paper trading provides feedback to identify weaknesses and fine tune your skills, helping avoid costly mistakes when live trading.

FOR MEMBERS

The long term duration of your trades means you focus on longstanding market trends and themes. The scoring formulas take into account multiple data points for each financial product and service. It is recommended that you only invest what you can afford to lose. Many day traders end up losing money because they fail to make trades that meet their own criteria. When traders use borrowed money to get a bigger position in the market than their own money would allow, this is called leverage. Understand audiences through statistics or combinations of data from different sources. For example, a scalper might purchase a stock with a significant premarket upsurge, aiming to sell shortly after for a quick profit. On Uphold’s WebsiteTerms Apply. Additionally, you also have to complete the KYC procedure. Profit and loss account shows the net profit and net loss of the business for the accounting period. These levels can provide valuable insight into potential entry and exit points for your trades throughout the day. Therefore, not letting your emotions get the best of you is important and can help you avoid making irrational and hasty decisions when trading. Real time market data can make the difference between making well informed trades and not. Jump in on the action by creating your own audio based show. Bajaj Financial Securities Limited is only a distributor. But investors who try to buy bottoms just like investors who try to sell at tops are at a greater risk of encountering a false signal, where the underlying stock attempts to put in a second bottom but subsequently breaks down. Shares on a stock exchange are from companies who have decided to sell their shares to the public so people across the world, sometimes these are called retail investors. A Xero survey found they’re cheaper to run than a bricks and mortar shop and return fatter margins in those crucial early years. The profitability of day trading depends on several factors, including the trader’s skill, strategy, and the amount of capital they can invest. To test for the best stock trading apps we first set up an account with the relevant provider, then we tested the service to see how the software could be used for for more than just basic stock trading. Or read our Kraken review.

General

Several items to consider include. Beginner friendly exchanges like Coinbase and Gemini offer quick buy features that charge higher fees. When you sign up for an Automated Investing account, the platform will ask a few questions about your risk preferences and then suggest an appropriate pre made portfolio. Traders should create a set of risk management orders including a limit order, a stop loss order and a take profit order to reduce any overnight risk. In the following lines, we’ll cover a simple yet effective forex scalping strategy in the 1 minute timeframe. Forex software programs are available for forex trading. Do not make payments through e mail links, WhatsApp or SMS. For many classes of options, traditional valuation techniques are intractable because of the complexity of the instrument. It also requires learning the specific trading rules. Now that we know the meaning of dabba trading, it is clear that this seems lucrative and offers opportunities for saving costs, but the risks involved are high. Tick Chart builds a new bar after a set number of trades, for example after every 500 trades. With its powerful rebalancing features, robust portfolio and risk analysis tools, nearly boundless opportunities for asset diversification, and available access to licensed brokers, investors will be hard pressed to find a better platform for managing portfolio risk than Interactive Brokers.

$32 54

Securities Exchange Act of 1934, as amended the”1934 act” and under applicable state laws in the United States. By the day’s end, they compare the profit making trades with loss making ones to analyse their loss or profit. Com 2023 Annual Awards. Below is a strategy in the Soybean futures market that constantly is in the market. Com, it offers both a proprietary app, called FOREX. The risk of loss in trading commodity interests can be substantial. Equiti Brokerage Seychelles Limited is a company incorporated with limited liability under the laws of the Republic of Seychelles, under registration number 8428558 1, with its registered and physical address at First Floor, Marina House, Eden Island, Republic of Seychelles. Please keep me updated on Trade Nation’s sponsorships, news, events and offers. With derivatives trading, you can go long or short – meaning you can make a profit if that market’s price rises or falls, as long as you predict it correctly. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Because it is more convenient and cost effective. TradeStation was an early disruptor in the online brokerage business by offering a suite of professional quality tools to individual investors. Robinhood also has an excellent mobile experience, with an interface designed specifically for mobile use, and has eliminated fees on all of the investments it offers, even options and cryptocurrencies. Our platform offers robust security features to protect your holdings, ensuring your investments are in safe hands. Find out how to trade with leverage. If you’ve visited any broker’s website, you have probably seen the advertisements for free $50,000 paper trading accounts.

Learn How Does Intraday Trading Work

For a complete education and in depth insight into simple yet powerful price action strategies, as well as insight into the world of professional trading from an experienced trading veteran, checkout my price action trading course for more information. The earnings per share EPS is a measure to provide investors with a quick idea of how profitable a company is. Trading is no exception. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Est membre de l’Organisme canadien de réglementation des investissements OCRI et du Fonds canadien de protection des épargnants. If using 10:1 leverage the trader is not required to have $5,000 in an account, even while trading $5,000 worth of currency. The data from the exchange is time stamped and your charting platform uses this to draw the bar. According to a study published in the “Journal of Technical Analysis” by David Aronson and Timothy Masters, titled “Evaluating the Performance of Candlestick Patterns in Financial Markets,” the Evening Star pattern has a success rate of approximately 69% in predicting bearish reversals. Scalping strategy requires stable volatility, as high volatility can hit the trader’s profit and loss account quite badly. SEBI study dated January 25, 2023 on “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options FandO Segment”, wherein Aggregate Level findings are based on annual Profit/Loss incurred by individual traders in equity FandO during FY 2021 22. What are the disadvantages of using an investing app to trade stocks. Scalping is a trading style where small price gaps created by the bid–ask spread are exploited by the speculator. Work less, earn more and read about the latest trends before everyone else 🫵. While all the brokerage platforms we examined charge no commissions for stock and ETF trades, option contract fees were factored into our ranking. Securities and Exchange Commission SEC, Futu Securities International Hong Kong Limited regulated by the Securities and Futures Commission of Hong Kong SFC, Moomoo Financial Singapore regulated by the Monetary Authority of Singapore MAS, Moomoo Financial Canada Inc. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe any such restrictions.

About NSE

If you are new in the ‘trading business’, you should definitely know about the unique products that we offer to our customers like ‘Target’; to analyse future profit prospects, ‘Portfolio Optimizer’; to select the best portfolio depending upon the required outcome, ‘Investmentz Buckets’; to determine the sensitivity of a portfolio, ‘DIY Screeners’; program to filter stocks as per customer’s requirements. That’s where automated trading comes in. Others have features like crypto staking or crypto loans that allow you to earn interest on your crypto holdings. While swing traders may hold stocks overnight to several weeks, day trades close within minutes or before the close of the market. The indicator plots the average closing values for each day on a line graph to chart the movements of an asset. Please see Robinhood Financial’s Fee Schedule to learn more. So, basically, trading means that you’re only predicting whether a financial asset’s price will rise or fall. This is done by multiplying the total number of shares shares outstanding with the price of one share. No fees to buy fractional shares. The Quantum AI Trading Platform stands as a pioneering achievement in the realm of artificial intelligence, enabling automated trading through self learning templates while minimizing potential risks. The Committee supported earlier disclosure of insider activities and recommended that the time given for insiders to report trades or declare that they had become insiders should be decreased to within 10 days of the person’s becoming an insider or making a trade. Image is for illustrative purposes only. As founder and editor in chief of NewTrading. ADVISORY KYC COMPLIANCE. Essentially, you’re selling an at the money short call spread in order to help pay for the extra out of the money long call at strike B. Tick charts can give you an impressive scope of market activity. The Nifty stock index chart has exhibited positive divergence as indicated by orange lines. Simplify your workflow and trade faster with REDI EMS. Scalpers aim to generate profits by taking advantage of even the tiniest fluctuations in prices, which can occur within seconds or minutes. The calculation of capital requirements for commodity position risk is set out in BIPRU 7. Based brokerages on StockBrokers. To create a combination trading strategy, you’ll need to carry out analysis of historical price action on an underlying market. This enables the app to provide you with an account that you, the app and, yes, tax authorities can link exclusively and reliably to you.